Governance Isn't Glamorous — Until It Costs You Time and Stress on a Deal

Uncover the 3 common governance slip-ups that derail deals and create stress. Learn a simple framework to keep your company compliant and deal-ready

Why Even "Mundane" Corporate Governance Matters

In over 20 years of offshore legal practice across Bermuda, the British Virgin Islands (BVI) and the Cayman Islands, I've seen many deals delayed — not by complex legal disputes or structuring issues, but by basic governance slip-ups.

A missing board resolution here. An outdated register there. A filing deadline quietly missed.

These aren't exotic legal problems. They're process failures. And they can hold up transactions for days and even weeks. Apart from creating added stress, they can also have serious financial consequences.

The irony? Even large, listed companies and banks make these mistakes. The difference is they have in-house teams, corporate service providers (CSPs) and lawyers on speed dial to fix them. I was often one of those lawyers.

For small businesses and solopreneurs, the margin for error is much thinner. Every dollar and hour counts — and there's rarely a safety net.

This post walks through the three most common governance gaps I see, why they matter more now, and a simple framework to help you avoid them.

💡 Want more posts like this? Subscribe to browngeek and get practical insights in your inbox.

The Three Governance Gaps That Derail Deals

1. The Authority and Validity Gap 🚫

The problem: Registers were not kept up to date, so a director appointment or change of shareholder may not be valid.

The consequence: Signatures on key documents — loan agreements, share transfers, board resolutions — could be challenged. Due diligence flags it. The deal stalls while you scramble to ratify or re-do the changes.

Common causes:

- Not checking if the company's memorandum and articles of association (M&A) require shareholder consent for director appointments

- Skipping board quorum or notice requirements

- Failing to obtain a signed consent to act from the incoming director

- Not updating the register of directors in a timely manner

2. The Records Gap 📝

The problem: Resolutions were not up to date, creating conditions precedent (CP) and warranty headaches in transactions.

The consequence: Lenders, investors and buyers conducting KYC or due diligence can't verify who has authority. CPs can't be satisfied. Warranty schedules become inaccurate. Deals pause or collapse.

Common causes:

- Assuming the CSP has updated the register (when the company is responsible)

- Relying on email chains, WhatsApp messages or informal notes instead of proper written resolutions

- Not maintaining a complete minute book or failing to file resolutions properly

3. The Filing and Compliance Gap 🛑

The problem: Timely filings were not made with company registries within the statutory deadline.

The consequence: Late filing fees, compliance red flags, and critically, delays in obtaining good standing certificates — which can stop a deal in its tracks.

Common causes:

- Not notifying the CSP of any relevant changes

- Not tracking the deadline

- Assuming "someone else will handle it"

These gaps create stress for founders. 💡 Want practical fixes and insights delivered straight to your inbox? Subscribe to browngeek

Why This Matters More Now

Regulators and company registries in international finance centres are increasingly pushing for better data quality, beneficial ownership transparency and stricter enforcement of statutory obligations.

Recent Regulatory Developments:

BVI: The BVI has introduced an annual financial return requirement, signalling a regulatory shift towards greater scrutiny of company records and filings. Companies must now submit detailed information annually, with penalties for non-compliance. (Source: BVI Financial Services Commission)

Cayman Islands: Enhanced beneficial ownership transparency requirements and tighter enforcement of statutory register obligations mean that record-keeping is no longer a "soft" requirement. (Source: Cayman Islands General Registry)

Bermuda: Companies must maintain and file an up-to-date register of directors and officers with the Registrar of Companies, with statutory timelines for notification of changes. (Source: Bermuda Registrar of Companies)

Global direction: The Financial Action Task Force (FATF) continues to push for stronger beneficial ownership transparency, raising the bar for what "good governance" looks like. (Source: FATF)

In short: Sloppy record-keeping is no longer a victimless admin lapse. It's a compliance risk and a deal-breaker.

Regulatory changes are constant. 💡 Stay ahead of the curve with simplified updates. Subscribe to browngeek

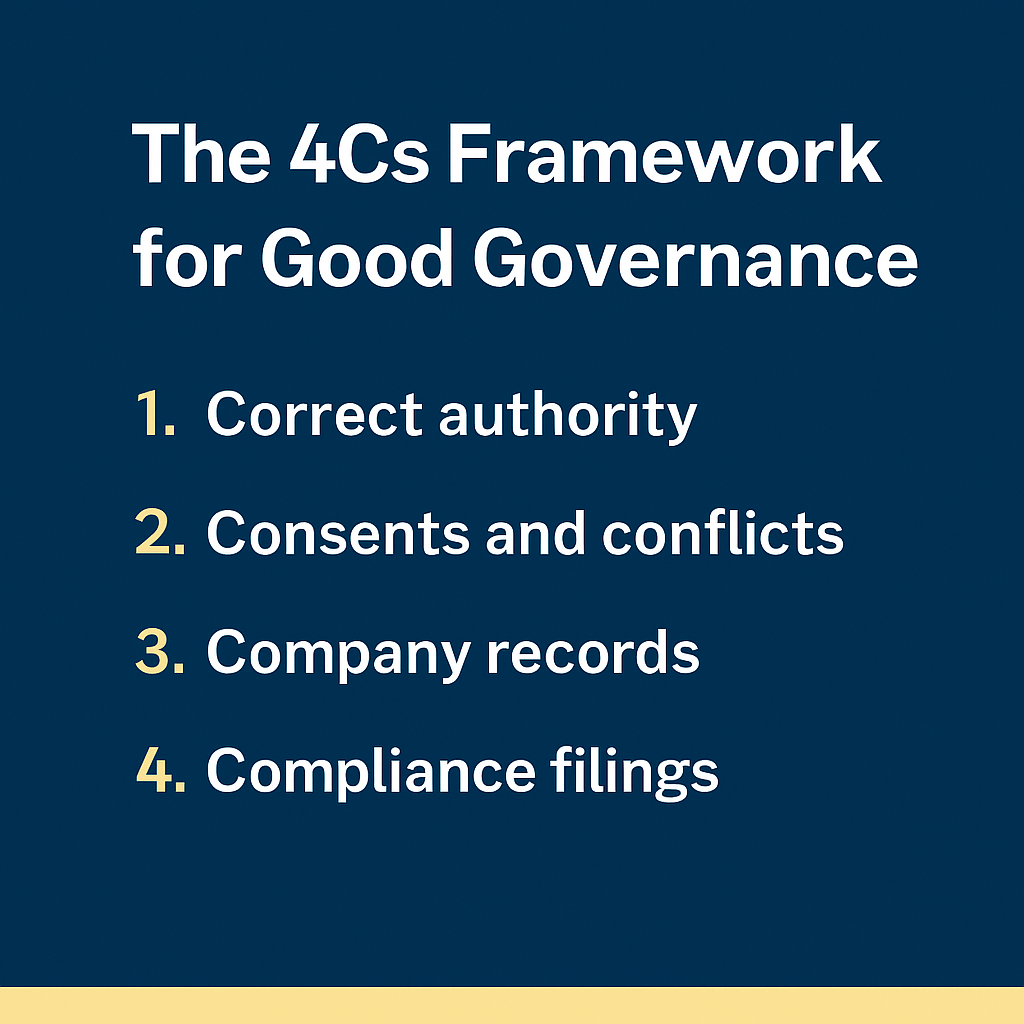

A Simple Framework: The 4Cs for Good Governance

Whether you're appointing or removing a director, issuing shares, or making any structural change in a company, use this checklist:

1. Correct Authority

Check your memorandum and articles of association: does the board have authority, or do shareholders need to approve?

Is there a shareholders agreement in place requiring additional approvals?

Ensure proper notice, quorum and voting requirements are met

Verify that the right corporate body (board vs shareholders) is making the decision

2. Consents and Conflicts

Obtain a signed consent to act from any incoming director

Obtain a signed resignation letter (or removal resolution) from any outgoing director

Record any conflicts of interest and ensure they are properly disclosed and managed

3. Company Records

Prepare a formal written resolution or memorandum (board or shareholder, as appropriate)

Update the register of directors and officers (and any other relevant statutory registers)

File the resolution and supporting documents in the minute book

Ensure the corporate records tell a complete, auditable story

4. Compliance Filings

Identify who is responsible for filing (you or your CSP)

Know where to file (BVI Registry, Cayman General Registry, Bermuda Registrar of Companies)

Know when to file (typically within 21–30 days, depending on jurisdiction and the type of change)

Confirm the filing has been completed and acknowledged by the registry

Getting the 4Cs right is crucial. 💡 Want more frameworks and checklists like this one? Subscribe to browngeek

Who This Helps

Large companies have the resources to manage these formalities through in-house teams or external advisers. For them, director changes and statutory filings are routine, and even then they sometimes get it wrong.

For small enterprises and solopreneurs, paying hundreds (or thousands) to a law firm or CSP for what feels like "basic admin" can seem disproportionate — especially when margins are tight.

- But getting it wrong is costly. A missed filing, an invalid appointment or an incomplete record can:

- Delay banking facilities or investor funding

- Trigger warranty breaches in transactions

- Expose the company (and directors) to fines, penalties or regulatory action

- Create personal liability risks for directors

What About AI?

Yes, AI tools like ChatGPT can draft a generic board resolution in seconds.

- But here's what they can't reliably do:

- Check your specific articles of association for quorum, notice or approval requirements

- Identify whether you need board or shareholder consent

- Provide jurisdiction-specific guidance on BVI, Cayman or Bermuda filing requirements and deadlines

- Produce a complete pack: resolution + consents + register updates + filing checklist + supporting letters

- Keep up with regulatory changes and enforcement trends

It's not the words on the page that make an appointment or transaction effective — it's the authority, the consents, the updated registers and the timely filings.

That's where expert-backed, jurisdiction-specific templates and systems add real value.

I'm Building Something to Help

I'm creating simple, professionally drafted template resolution packs for common corporate actions in Bermuda, BVI and Cayman.

Each pack includes:

- Written resolutions (board and shareholder variants)

- Consent to act and resignation letter templates

- Register update checklist

- Filing deadline tracker and registry contact details

- Explanatory notes on common articles pitfalls and jurisdiction-specific requirements

These are designed for smaller companies and solopreneurs who want to get governance right without big-firm fees.

📥 Want Early Access?

I'm releasing a free BVI director change starter pack this week: resolution + simple checklist.

Sign up here to receive your free pack.

Final Thoughts

Governance won't make headlines. But it will save you time, money and stress.

Whether you're a founder, a finance director, an in-house lawyer or a company secretary managing a portfolio of entities, getting the basics right matters.

If you've experienced governance slip-ups that stalled a deal or created unexpected headaches, I'd love to hear your story.